Current Loan and Deposit Account Rates

Loan Rates

Loan rates effective APRIL 1, 2025 Prime Rate = 7.50% effective 12/18/2024 APR = Annual Percentage Rate

| Loan Type | Annual Percentage Rate | Notes |

| Auto Loans NEW | Rates as low as 5.99% CLICK HERE for DISCOUNT LIST Fixed Rate |

Recreational Vehicles including motorcycles, boats and RV’s ADD 1.00% to calculated rate. |

| Auto Loans – USED (2020-2023) | Rates as low as 6.49% CLICK HERE for DISCOUNT LIST Fixed Rate |

Auto Loans – USED Model Years 2016-2019. Rates as low as 7.49%. Recreational Vehicles including motorcycles, boats and RV’s ADD 1.00% to calculated rate. |

| Bill Consolidation and Signature Loans | Rates as low as 10.49% | Up to 60 months |

| MOD (Money-On-Demand Line of Credit) | 15.00% | N/A |

| VISA | 15.24% | With 25 day grace period |

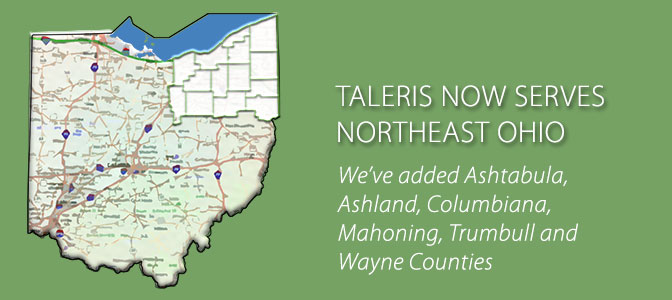

| Home Equity | As low as Prime minus 0.25% | 80% LTV, Prime minus 0.25%, available in OH, IN, KY, PA, TN, MI, GA, IL, MO, NJ, NC, SC |

| Second Mortgage | 4.49% (5 yr), 5.99% (10 yr), 6.24% (15 yr) | Fixed rate, available in Ohio only |

| First Mortgage | Call for current rates | Fixed / Variable, 15-30 year terms, available only in Ohio |

| Stock Secured Loans | 8.50% | N/A |

| Share Secured Loans | 3.00% above primary share, term share certificates and money market rate: Not lower than designated floor rate | N/A |

- 20% down payment, payroll deduction and Green Saver package (in combination) = 1.00% discount

- Direct Deposit of Net Pay (new) = 0.50% discount OR (only 1 discount applies) Automatic Payroll Payment of a Loan = 0.25% discount

- Green Saver (new) (Bill Pay, E-Statements, & Debit Card) = 0.25% discount

- Fuel Efficient, Electric, or Hybrid vehicle purchase = 0.10% discount Fuel Efficient Autos, which are five years old or less, and get 30 mpg Hwy or more, and have less than 75,000 mile

The maximum rate discount a member may earn on any one loan is 1.00%. However, at no time will the member’s rate with discounts go lower than the credit union’s designated floor rate (4.49% APR) or current promotional rate. Discounts do not apply to all lending products (does not include: MOD, VISA, Home Equity and Mortgages). For more information on TCU Loan Rate Discounts, please contact a Loan Representative at 800.828.6446.

___________________________________________________________________________

Deposit Account Rates

Term Share Certificates

Effective Date: APRIL 16, 2025 $500 minimum deposit required | Rate Adjusted Weekly | Calculated daily | *Dividends paid at maturity | **Dividends paid quarterly | Penalty may be imposed for early withdrawal

| Term (Months) | Yield (APY*) | Dividend Rate |

| 3 to 5 | 1.00%* | 0.996%* |

| 6 to 11 | 3.95%** | 3.893%** |

| 12 to 17 | 3.95%** | 3.893%** |

| 18 to 23 | 3.80%** | 3.747%** |

| 24 to 29 | 3.65%** | 3.601%** |

| 30 to 35 | 3.65%** | 3.601%** |

| 36 to 47 | 3.55%** | 3.504%** |

| 48 to 59 | 3.45%** | 3.504%** |

| 60 | 3.45%** | 3.406%** |

*APY = Annual Percentage Yield

IRA (Individual Retirement Account) Certificates

Effective Date: APRIL 16, 2025 $500 minimum deposit required | Rate Adjusted Weekly | Calculated daily | *Dividends paid at maturity | **Dividends paid quarterly Includes Traditional IRA, Roth IRA and Coverdell Educational Savings Account

| Term (Months) | Yield (APY*) | Dividend Rate |

| 3 to 5 | 1.00%* | 0.996%* |

| 6 to 11 | 3.95%** | 3.893%** |

| 12 to 17 | 3.95%** | 3.893%** |

| 18 to 23 | 3.80%** | 3.747%** |

| 24 to 29 | 3.65%** | 3.601%** |

| 30 to 35 | 3.65%** | 3.601%** |

| 36 to 47 | 3.55%** | 3.504%** |

| 48 to 59 | 3.45%** | 3.504%** |

| 60 | 3.45%** | 3.406%** |

*APY = Annual Percentage Yield

IRA (Individual Retirement Account) Savings

Effective Date: APRIL 1, 2025 $100 Minimum Deposit | Rate adjusted monthly | Calculated daily | Paid quarterly

| Yield (APY*) | Dividend Rate |

| 0.20% | 0.200% |

*APY = Annual Percentage Yield

Money Market Share Account (MMSA)

Effective Date: APRIL 16, 2025 $100 Minimum Deposit | Rate adjusted weekly | Calculated daily | Dividends calculated daily | Paid monthly

| Deposit Category | Yield (APY*) | Dividend Rate |

| $100 – $4,999 | 0.40% | 0.399% |

| $5,000 – $24,999 | 0.60% | 0.599% |

| $25,000 – $49,999 | 0.80% | 0.798% |

| $50,000 and over | 1.00% | 0.996% |

*APY = Annual Percentage Yield

Primary Share / Business Savings / Holiday & Club Accounts (Statement Savings)

Effective Date: APRIL 1, 2025 $100 Minimum Deposit required to earn dividends | Rate adjusted monthly |Dividends calculated daily on the balance in each category |Paid quarterly

| APY* (Lowest) | APY* (Highest) |

| 0.050% | 0.050% |

*APY = Annual Percentage Yield

Premier Business Checking Account

Effective Date: APRIL 1, 2025

| Balance | Yield (APY*) | Dividend Rate |

| All | 0.025% | 0.025% |

*APY = Annual Percentage Yield

Classic Checking Account

Effective Date: APRIL 1, 2025 There is no Minimum Deposit. Daily balance is required to earn tier dividends. Dividends calculated daily | Paid quarterly | Rate adjusted monthly

| Balance | Yield (APY*) | Dividend Rate |

| $0.00 – $999.99 | 0.025% | 0.025% |

| $1,000 and over | 0.025% | 0.025% |

____________________________________________________________________________________

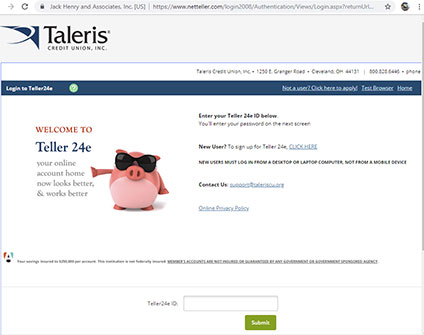

About Taleris

- About Taleris

- Branch Information

- Shared Branches

- ATM Networks

- Current Rates

- American Share Deposit Insurance

- Taleris Holidays

- Taleris Privacy Policy

- Mission Statement

- Taleris Board and Officers

- Employment Opportunities

- Volunteer Opportunities

- Commercial Videos

- Accessibility Statement

- Third Party Site Disclaimer